Objective Business Valuations in Tampa for Every Need

Nielsen Valuation Florida provides independent business appraisals across Tampa and the greater Bay region. Our opinions are built on evidence, aligned with IRS guidance, and prepared to stand up in negotiations or the courtroom. Reach out for a tailored quote today.

What We Do in Tampa

Nielsen Valuation Florida supports Tampa companies with credible, purpose-built valuations for scenarios such as:

- Company acquisitions and sales (excluding start up valuations)

- Corporate reorganizations or orderly wind-downs

- ESOP design and share pricing

- Tax planning and filing support

- Disputes, damages, and expert testimony

- Partner redemptions and buyouts

- Pricing for buy–sell agreements

- Shareholder and member disputes

- Financial reporting & strategic planning

- Financing, SBA, and lender diligence

- Divorce valuations and equitable distribution

- Capital raises and investor relations

- Estate, gift, and probate engagements

- Insurance, coverage, and risk needs

- Mergers & acquisitions support

- Other bespoke assignments

Why Tampa Businesses Work With Us

Clients choose our Florida valuation services because our conclusions are independent, clearly explained, and anchored in how the business truly operates. We tailor every assignment to its purpose: transactions, planning, tax, or disputes, and look past raw statements to the facts that drive value.

We’re local to the Tampa Bay market, which makes it simple to meet face-to-face or conduct an on-site review when it adds depth to the analysis.

Grounded in IRS 59-60, Not Guesswork

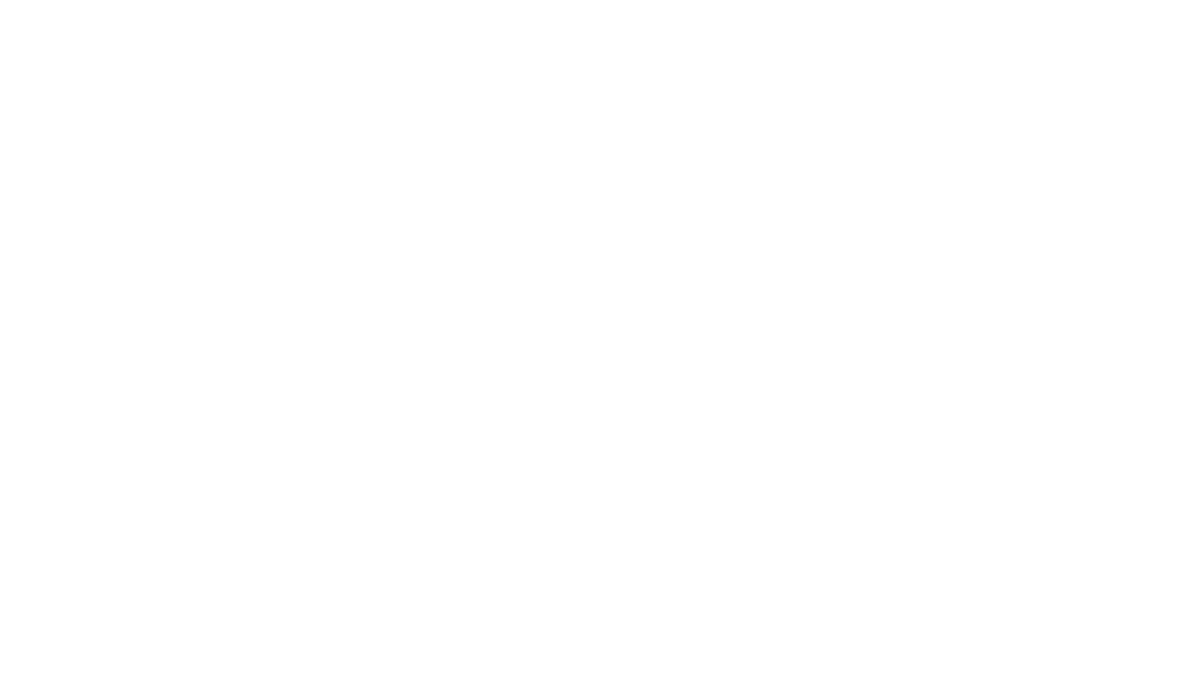

Different appraisers can land far apart. Our north star is fair market value rather than optimism or spin.

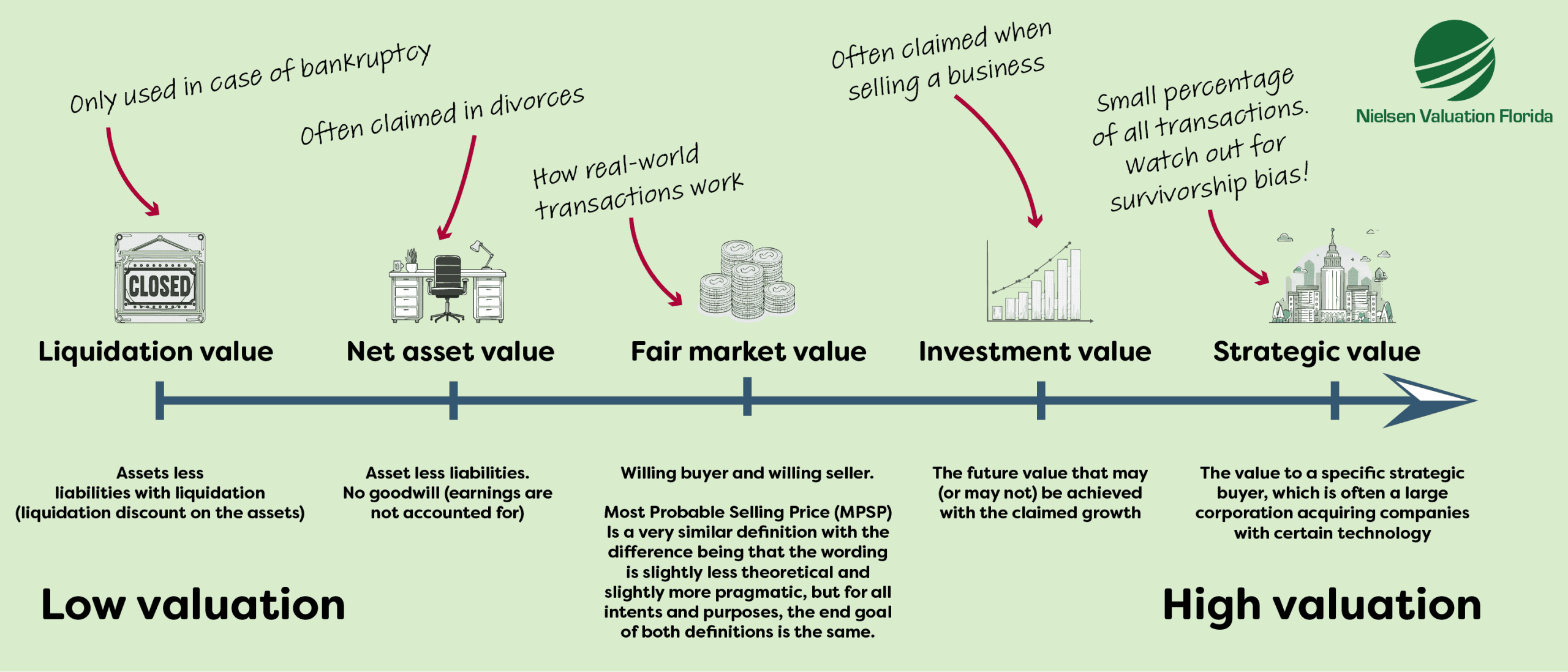

We follow IRS Revenue Ruling 59-60, which cautions against prescribed formulas, standardized cap-rate tables, and theoretical marketability discounts.

Every report is prepared in line with this framework. Practically, that means we analyze the company’s economics, risks, and market context so our opinion reflects what informed parties would actually pay.

Beyond the Ledger: Normalize First

Book numbers rarely tell the whole story. Statements often include one-offs, owner-specific items, or assets carried at costs that don’t match market reality.

We begin by normalizing earnings and the balance sheet, removing non-recurring items and marking assets to market when supportable, then carry out the valuation. That sequence produces results you can defend.

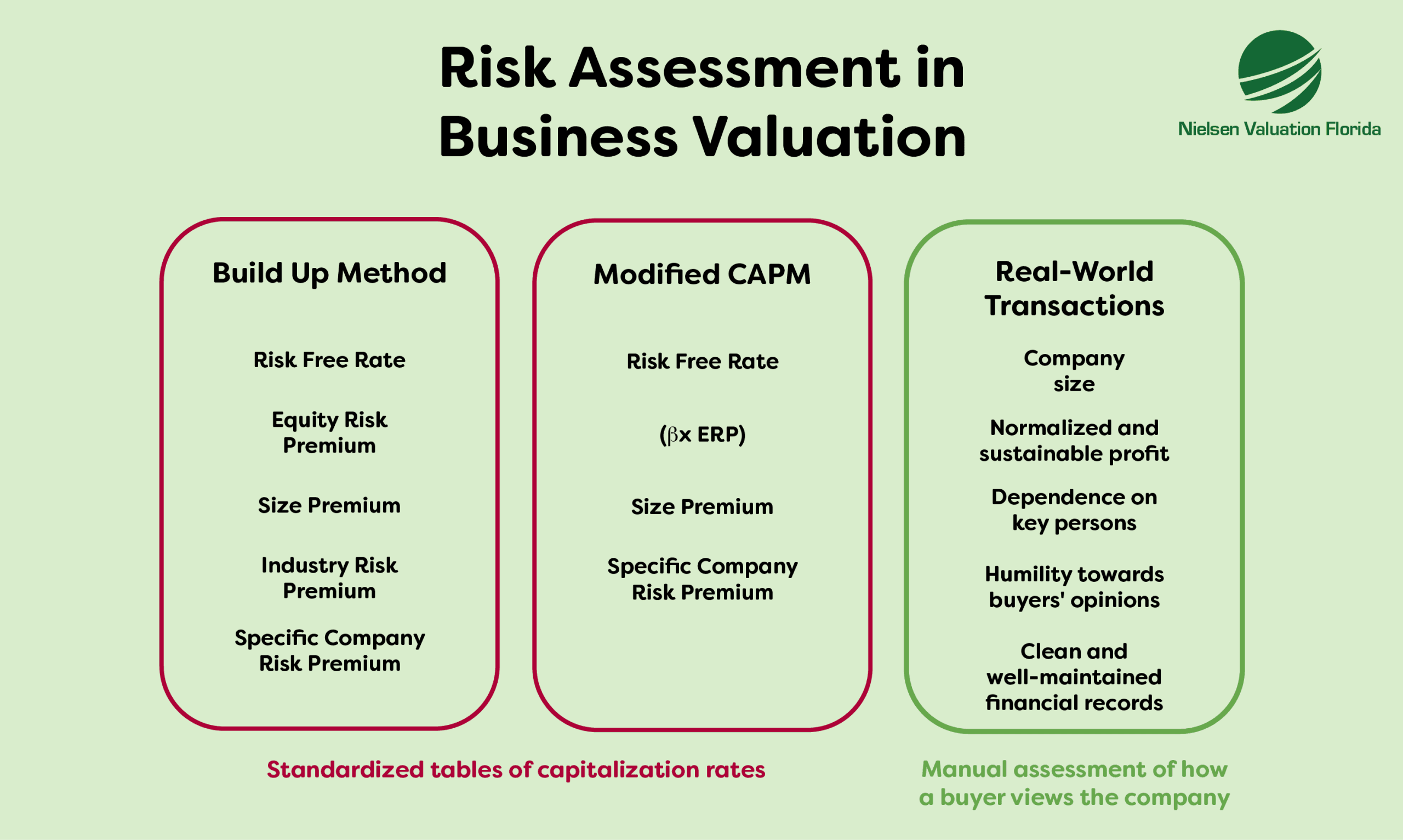

From there we estimate fair market value, the price a willing buyer and willing seller would agree to without pressure and with reasonable knowledge, applying any discounts only when the facts justify them.

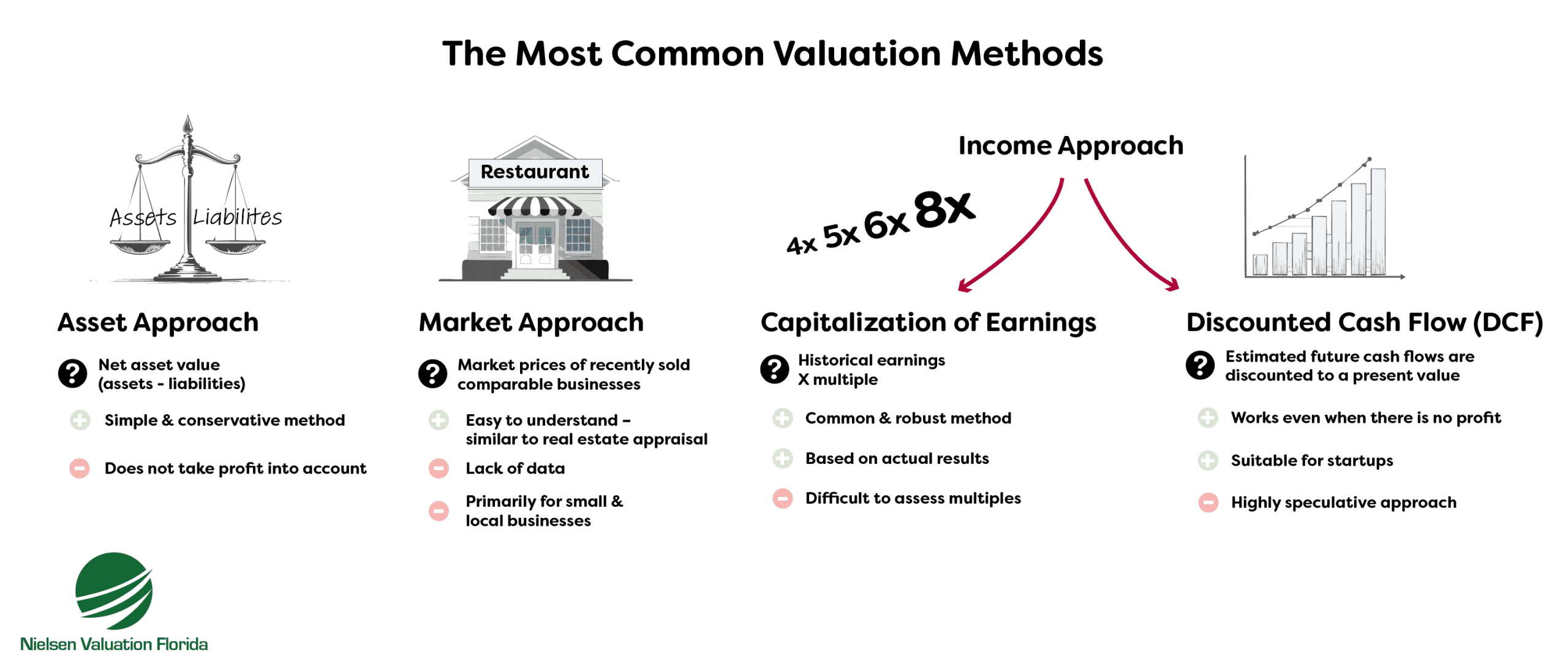

Methodologies Matched to Your Situation

No templates, no autopilot. Based on your industry, risk, and purpose, we select one or more approaches and apply them with care.

Common approaches include:

- Asset approach — net asset value at market levels

- Income approach — earnings or cash-flow driven

- Market approach — guided by comparable transactions around Tampa Bay

By matching method to evidence and documenting assumptions we produce defensible opinions of value that counterparties can accept.

A Custom Scope for Your Business Valuation

Every company is different, which we acknowledge in our business valuations. From the first conversation we shape the engagement around your goals and your situation. Book a complimentary 30-minute consultation and we’ll follow with a custom quote, so you’re only paying for work you actually need.

How Much Is My Tampa Business Worth?

If you’re preparing to sell a company, the critical number is what an informed buyer will pay. This is often distinct from a purely theoretical figure, as many business owners brutally find out after being deceived by inflated or unrealistic valuations.

We usually encounter two kinds of misconceptions among business sellers in Tampa and elsewhere:

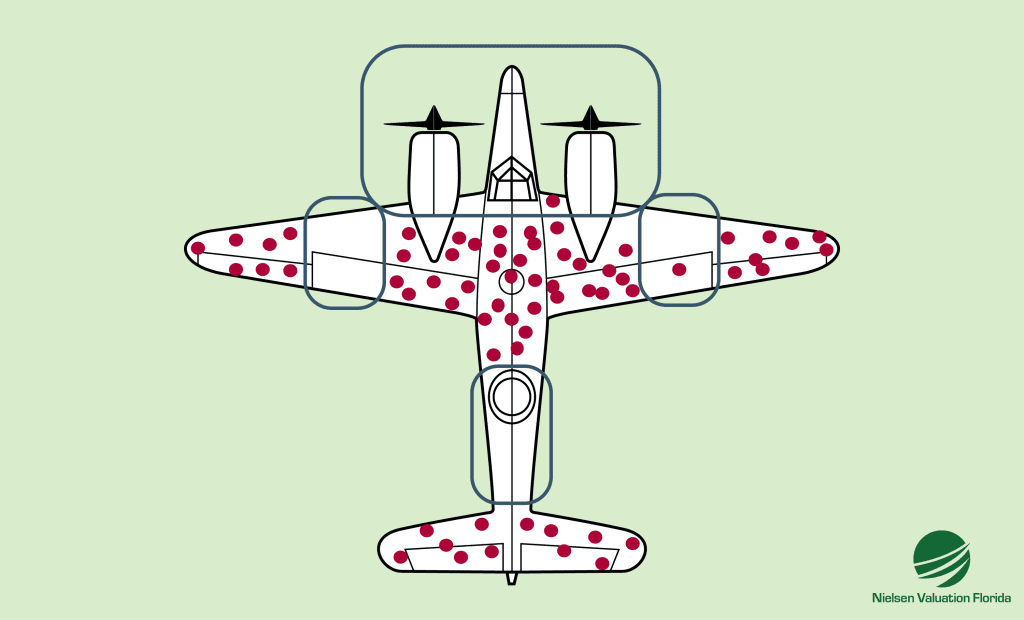

- Owners sometimes try to price tomorrow’s upside into today’s deal. Seasoned acquirers usually prefer to pay for the enterprise as it stands and earn future gains through their own effort and capital. A clear, third-party valuation helps bridge that expectation gap.

- Another pitfall is survivorship bias: focusing on headline success stories while overlooking how many ventures don’t reach the same outcome. Professional buyers account for that reality in their offers, and a sound valuation should as well.

Looking for a Business Valuation in Tampa?

Start with a free 30-minute consultation. Nielsen Valuation Florida will scope the work and send a personalized quote.