Objective Business Valuations in Orlando, Built for Your Situation

Nielsen Valuation Florida delivers independent, Orlando-based business appraisals. Our work is customized to your goals, non-speculative, and aligned with IRS guidance. Reach out for a fast, tailored quote.

Orlando Valuation Services

We provide appraisals for most scenarios (but we don’t value pure start-ups):

- Selling your company

- Acquiring a business

- Mergers & acquisitions

- Raising capital and bringing in investors

- Partner buyouts, buy-sell terms & shareholder disputes

- Divorce and equitable distribution

- Estate, gift & succession planning

- Tax planning & compliance

- Restructuring or business wind-down

- Financing, SBA and lender requirements

- Insurance and risk management

- Litigation support

- ESOP share pricing

- Financial reporting & strategic planning

- And more!

Why Orlando Companies Choose Us

Nielsen Valuation Florida is Central Florida’s specialist in independent business valuation. We’re nearby for face-to-face meetings and can tour your facilities when on-site work strengthens the analysis.

Clients describe our reports as clear, balanced, and decision-ready.

We anchor on fair market value and tailor scope to the purpose: transaction, planning, tax, or dispute, while avoiding speculation. That makes our conclusions useful in tough negotiations and admissible in litigation.

Fully IRS-Aligned And Non-Speculative

Cut-and-paste formulas and rosy assumptions produce unreliable numbers. We don’t do that.

Business owners need valuations they can trust in real negotiations.

Internal Revenue Service (IRS) Revenue Ruling 59-60 cautions against preset formulas, standardized cap-rate tables, and theoretical marketability discounts. We respect that guidance on every assignment.

For our Orlando engagements, we ensure full alignment with IRS expectations so your appraisal carries weight, whether you’re working with a buyer or seller, a partner, or presenting in court.

Above all, we focus on the business as it actually operates: facts on the ground, not wishful thinking.

Beyond the Financials: We Always Normalize First

Automated “calculator” valuations simply echo the balance sheet and P&L. That’s why they miss the mark.

Our Orlando process starts by looking past raw statements, normalizing results to reflect economic reality.

That includes valuing assets to market (where supportable) and adjusting earnings for one-offs, owner-specific items, or non-recurring expenses and revenues among other things.

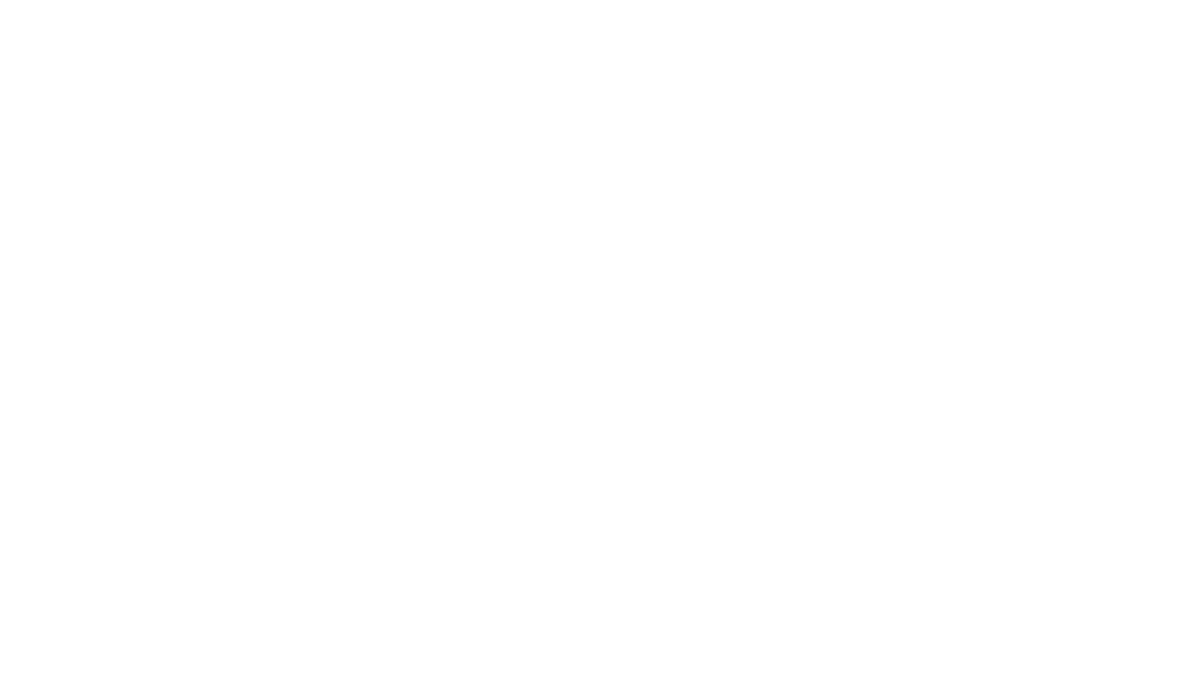

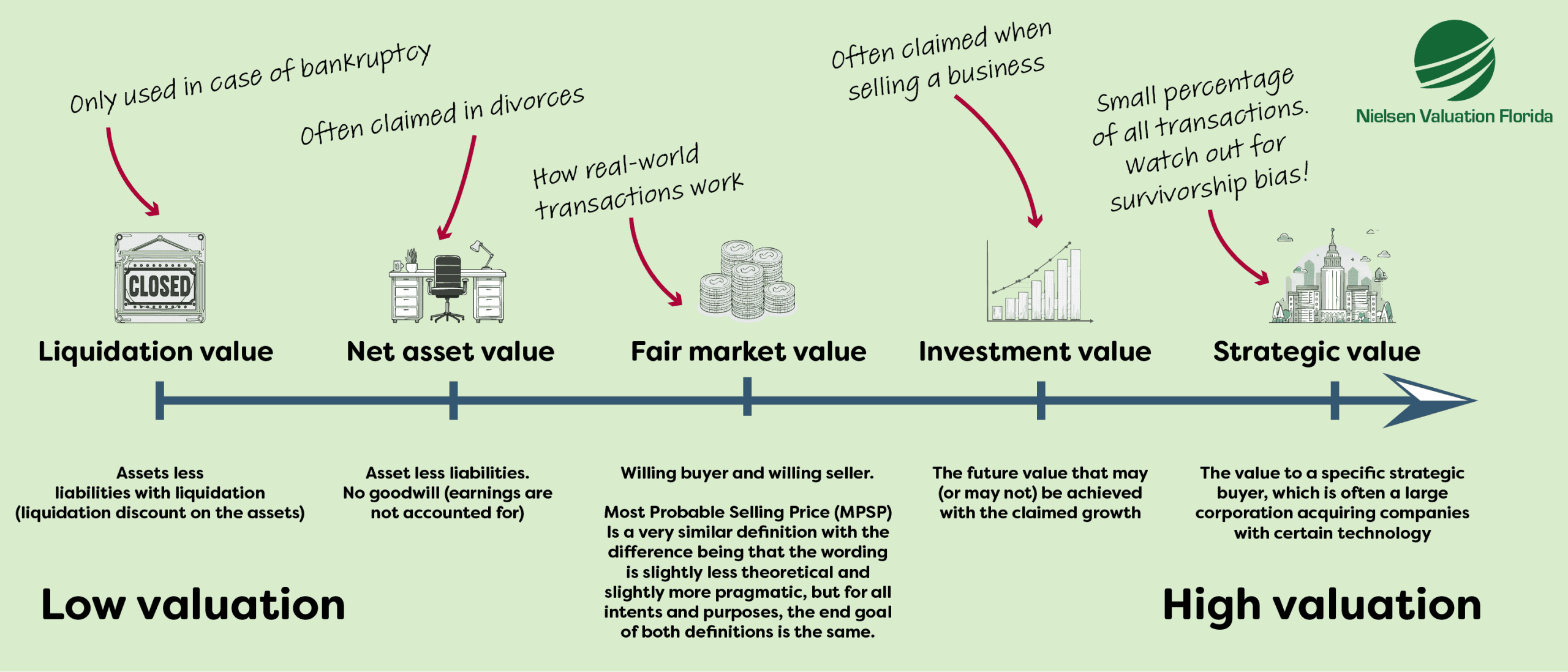

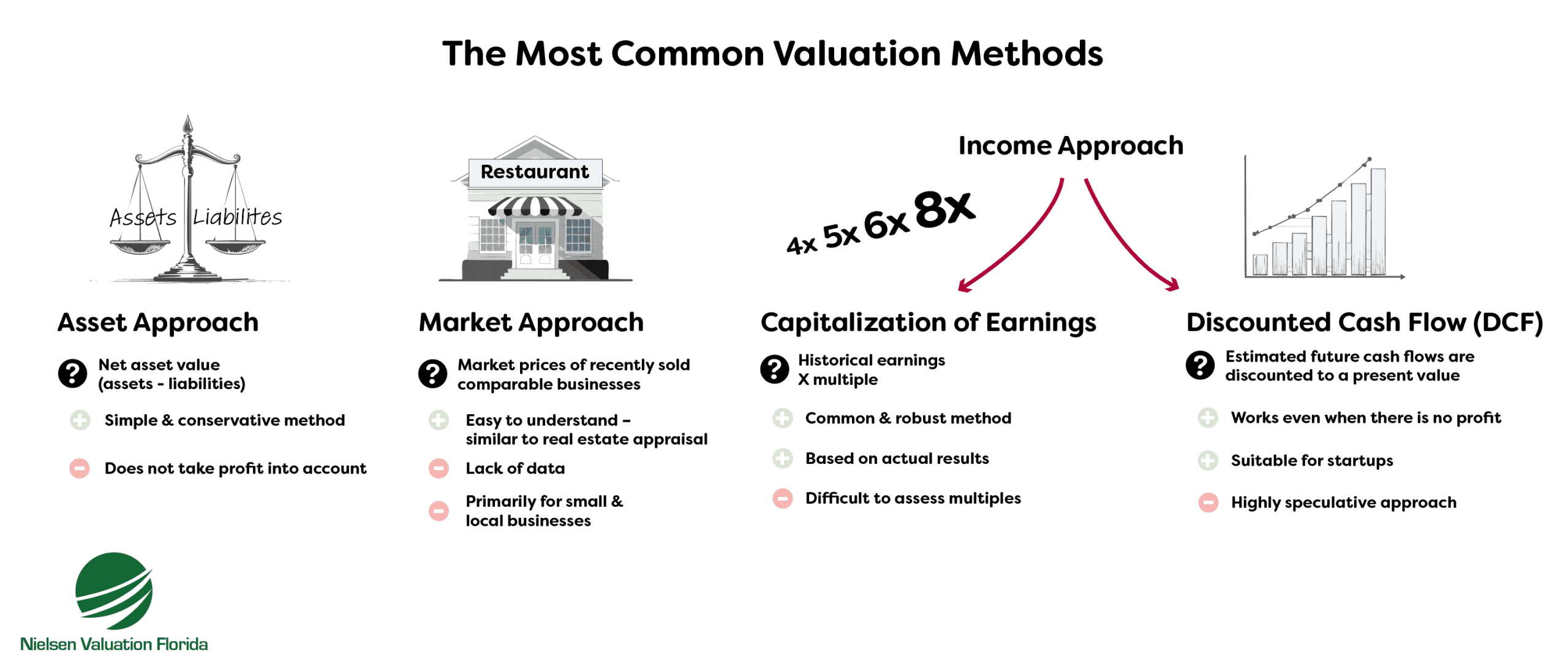

Wisely Choosing Among Methods

No two companies look the same. The choice of approaches needs to reflect the reality. We apply an approach, or mix of approaches, that best fits your industry, earnings profile, and purpose.

Common approaches include:

- Market approach — informed by what comparable companies in Orlando/Central Florida trade for

- Income approach — earnings/cash-flow based with risk properly assessed

- Asset approach — net asset value at market, less liabilities

Whichever path we take, we avoid unnecessary speculation and document assumptions, resulting in a valuation you can defend.

Orlando Valuations: Tailored, Not Template-Based

There’s no “one size fits all” in business valuation. From the first call, we tailor the scope to your goals. Book a free 30-minute consultation and we’ll follow up with a custom quote, so you don’t pay for services you don’t need.

What Is My Orlando Business Worth?

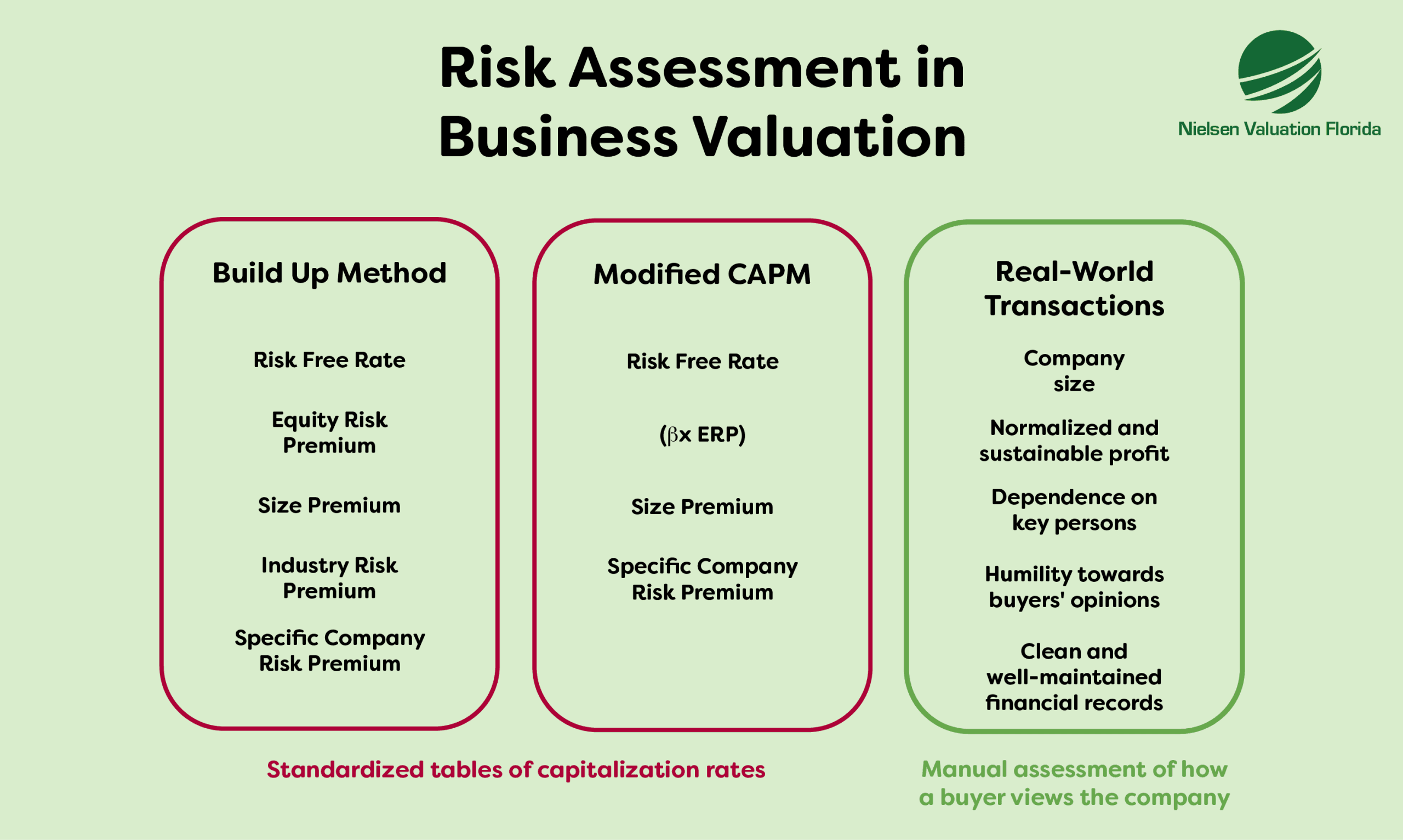

Preparing to sell a company in Orlando? The number that matters is what a well-informed buyer will pay—not a theoretical output from a formula that some valuation companies might present.

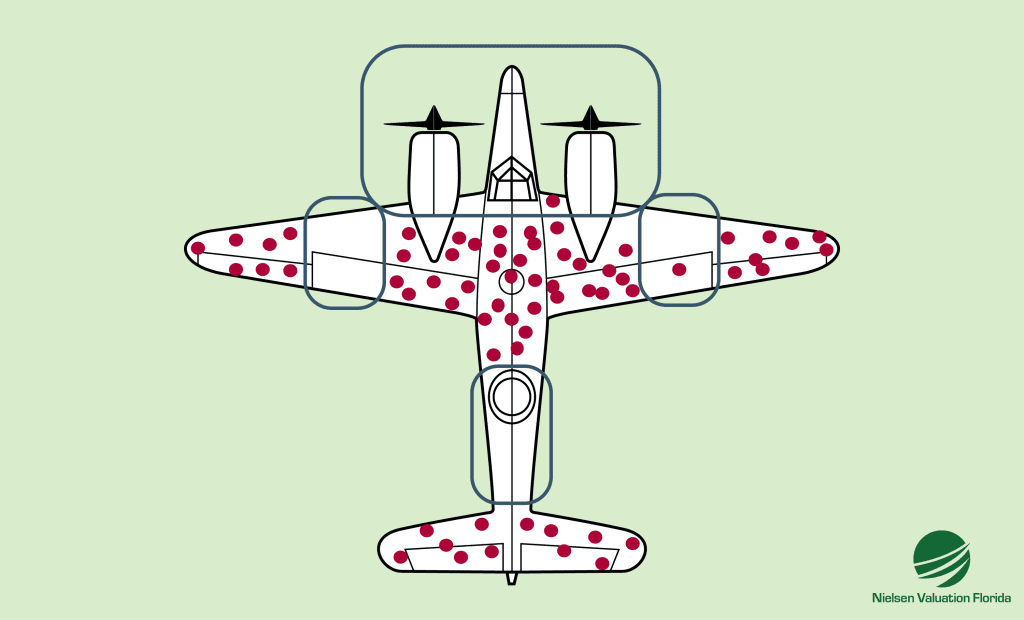

When meeting with Orlando businesses we often hear two misconceptions about value:

The first is that sellers sometimes wish to price today for tomorrow’s “potential.” Buyers, however, expect to capture the upside they create with their capital and execution. A balanced, independent valuation keeps expectations grounded.

The second is survivorship bias. Sellers often point to outlier successes (such as Alphabet, Meta, Spotify, PayPal), ignoring how many ventures don’t make it. Professional buyers price that risk into their offers.

Our valuations reflect the reality on the ground, not wishful thinking.

Need a Business Valuation in Orlando?

Questions about our Orlando valuation services? Want a quote or a free consultation? We’re ready to help.