Independent business valuations in Fort Lauderdale for every purpose

Nielsen Valuation Florida is a dependable choice when you need an impartial business appraisal in Fort Lauderdale, FL. Our opinions reflect the reality of the company, not wishful thinking or cookie-cutter formulas, and are prepared in line with IRS guidance.

Our Services in Fort Lauderdale

We provide business valuation services in Fort Lauderdale for a wide range of needs (however please note that we do not appraise pure start-ups):

- Buying or selling a company

- Capital raises and investor diligence

- Mergers & acquisitions support

- Divorce valuation and equitable distribution

- Buy–sell agreements, partner redemptions & shareholder matters

- Tax planning & compliance engagements

- Estate, gift & succession planning

- Financing, SBA and lender requests

- Restructurings or orderly wind-downs

- Insurance and coverage needs

- ESOP feasibility and pricing

- Litigation support and expert analysis

- Strategic planning & financial reporting

- And other tailored assignments

Why Partner With Us for Your Fort Lauderdale Valuation?

Nielsen Valuation Florida serves clients throughout Broward and South Florida, and we’re glad to meet on site when that adds clarity to the work.

Good valuations reflect how a specific company actually operates—its risks, its customers, and the economics behind the numbers. We dig into those drivers instead of relying on surface-level figures or generic rules of thumb.

Our process blends careful normalization with sound methods to produce a fair, well-explained conclusion in full alignment with IRS guidance. The aim is fair market value, not blue-sky projections. Because assumptions are documented and tied to facts, our work carries weight in negotiations and in contested matters.

No Shortcuts

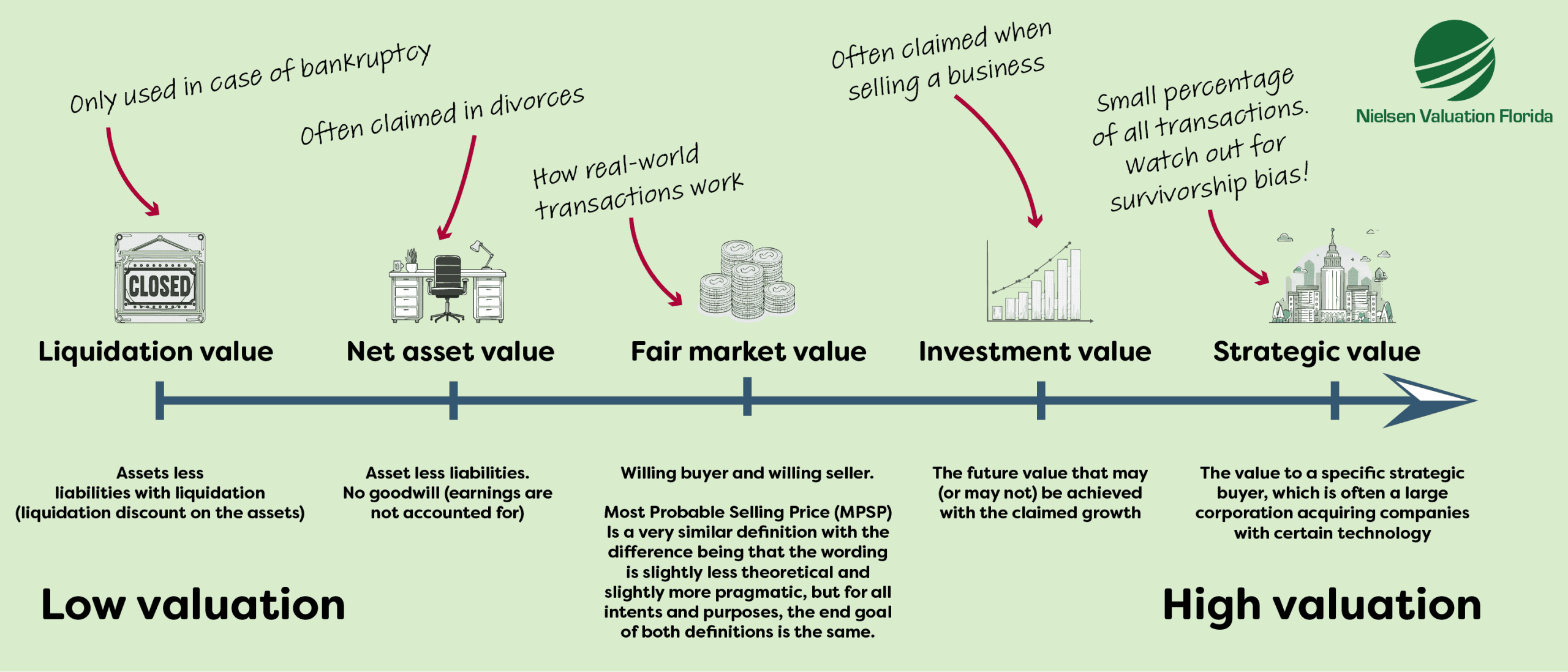

Reports from some business valuation companies lean on preset multipliers or cap-rate tables. Ours don’t.

IRS Revenue Ruling 59-60 cautions against predetermined formulas, standardized capitalization rates, and discount schedules pulled from theory rather than evidence.

Our reports are built to conform with these principles. We assess the company, its market, and its risk profile so the result mirrors what informed parties would agree to in an open market.

See Past the Numbers

Balance sheets and income statements are a starting point, not the answer. To reach a defendable conclusion, we first make the numbers representative of normal operations.

Here’s what that looks like in practice:

- Balance sheet reality check: we align asset values with supportable market evidence before we run the math.

- Earnings normalization: we adjust for one-offs, owner-specific items, and other irregulars so cash flows reflect ongoing economics.

Only after those steps do we perform the valuation. If discounts are relevant, they’re applied based on facts and engagement purpose, not on a template.

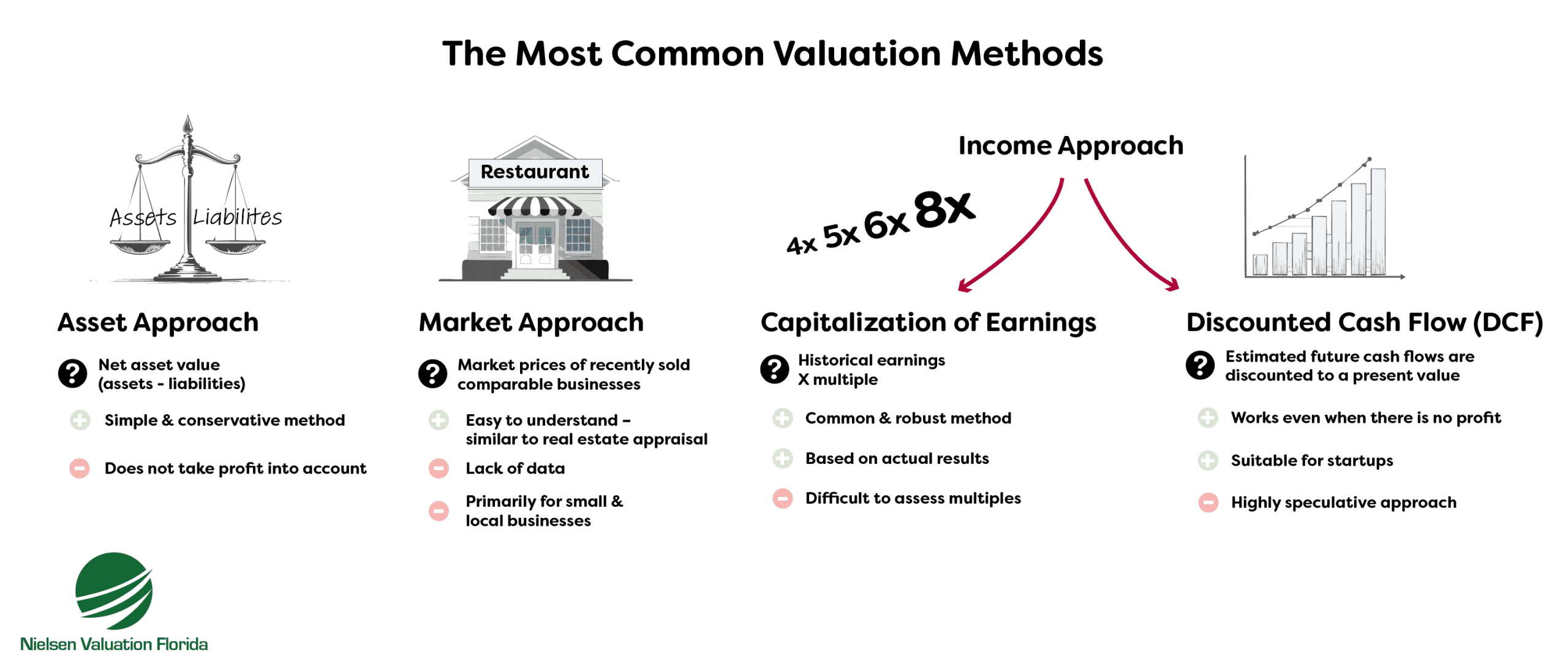

Sound Methods, Matched to Your Business

Valuation theory is broad; real businesses are specific. We select and apply methodologies that fit your company and the assignment’s purpose.

Core approaches include:

- Income approach – values supported by earnings or cash flow

- Market approach – reference to comparable transactions in the Fort Lauderdale area

- Asset approach – net asset value at market levels

For Fort Lauderdale engagements, we document each step so your stakeholders can follow the reasoning and trust the result.

Every Fort Lauderdale Valuation That We Do Is Tailored

From the first conversation, you’ll receive a custom proposal for your business valuation. We offer a complimentary 30-minute consultation to understand your goals and the business context, then follow with a proposal calibrated to your needs, so you don’t pay for work you won’t use.

How Much Is My Fort Lauderdale Business Worth?

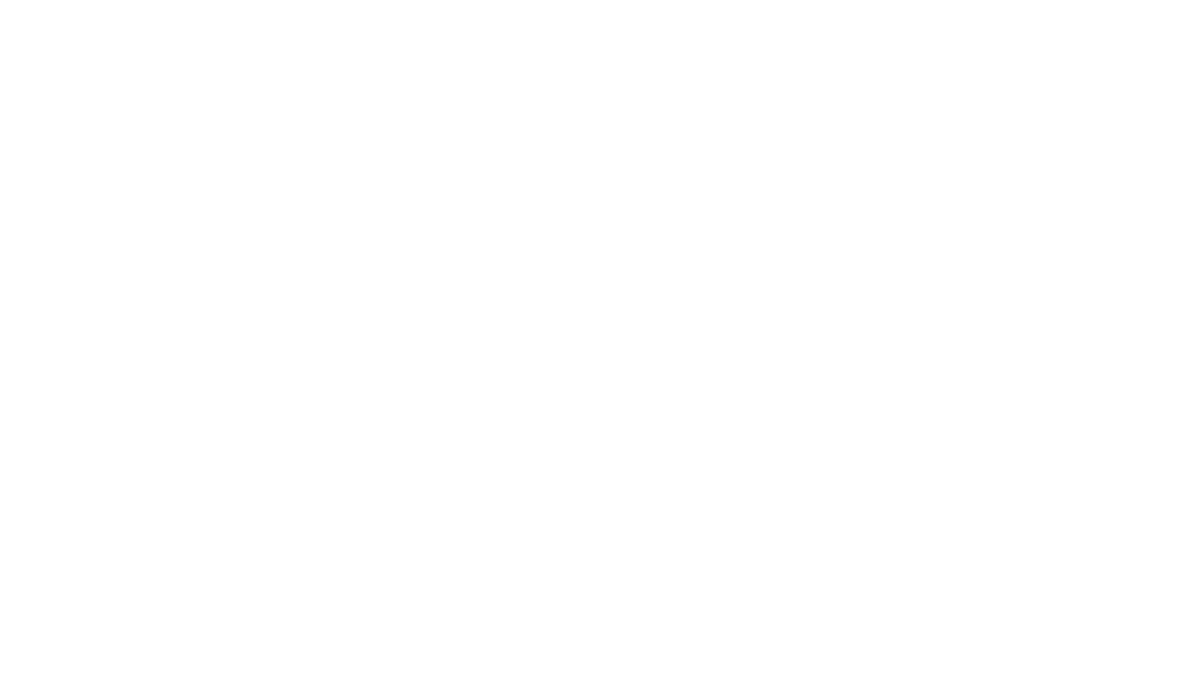

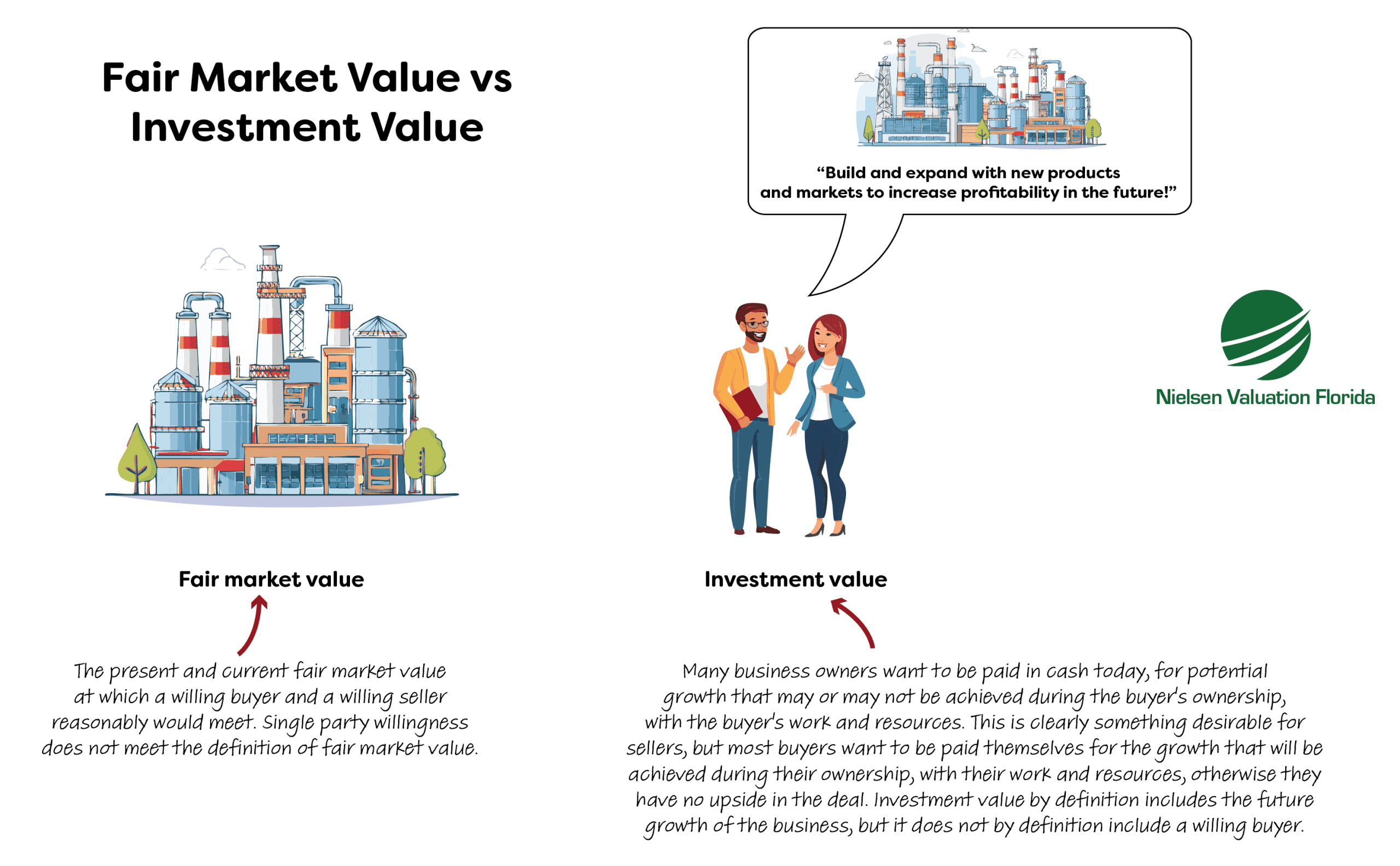

If you plan to sell your company, the only meaningful number is what a capable buyer would actually pay in today’s market. That is often different from any theoretical model.

Let us explain:

Owners sometimes try to price tomorrow’s possibilities into today’s deal. That’s a fault, because by doing so you are unlikely to find a buyer. Experienced acquirers typically value the business as it stands and expect to earn future gains through their own capital and execution. A clear, independent opinion helps align expectations and set a price the market will recognize.

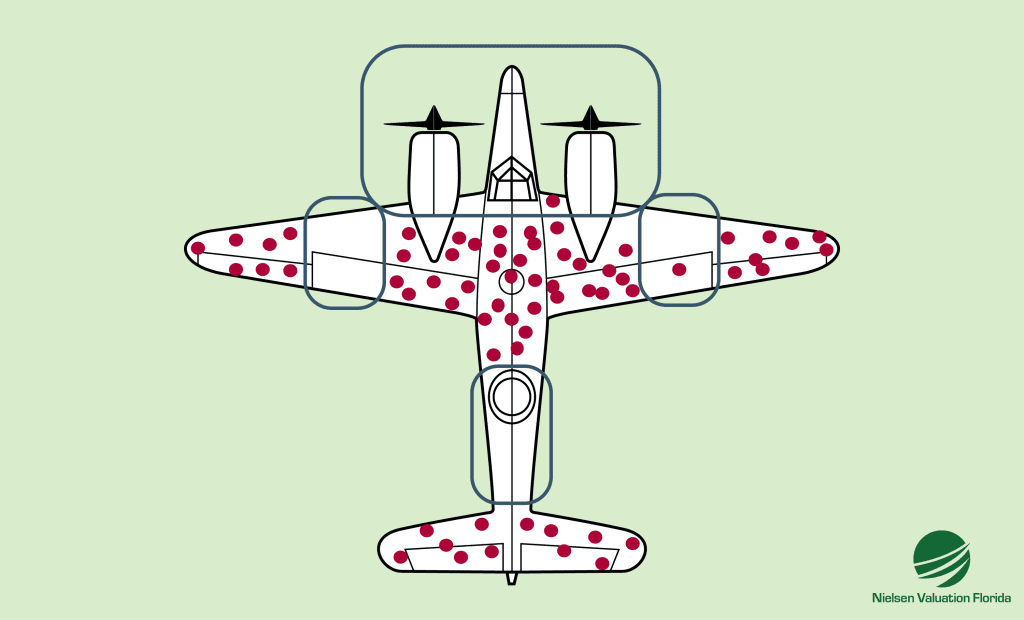

Be mindful of survivorship bias as well. Headline wins like Tesla, Microsoft and Uber are visible, while the many that don’t scale or succeed long term rarely make the news. Professional investors price that risk, and a balanced valuation should too.

Need a Business Valuation in Fort Lauderdale?

Nielsen Valuation Florida provides fair, well-supported opinions of value based on fair market value. Book a free consultation to get started.