Independent Business Valuations for Miami Companies

Nielsen Valuation Florida is the trusted appraisal partner for Miami businesses. Our opinions of value are grounded in proven methods: objective, non-speculative, and fully IRS compliant. We tailor scope and cost to your needs.

What We Do in Miami

Nielsen Valuation Florida appraises privately held companies of many sizes and industries (start-ups excluded). Typical reasons clients in Miami hire us include:

- Buying or selling a company

- Raising investment capital

- Mergers & acquisitions

- Partner buyouts, buy-sell terms & shareholder matters

- ESOP share pricing

- Divorce and equitable distribution

- Estate, gift & succession planning

- Restructuring or winding down

- Tax planning & compliance

- Financing and SBA/lender requirements

- Litigation support & expert reports

- Insurance and risk management

- Strategic planning & financial reporting

- And more

Why Miami Businesses Choose Us

Nielsen Valuation Florida is your local Miami resource for independent valuations. We frequently meet clients face-to-face and offer on-site visits when a deeper review is needed.

Expect balanced, plain-English reports tailored to your purpose. We prioritize IRS standards and rulings, aiming squarely at fair market value, not wishful thinking.

Practical, IRS-Aligned Valuations

Our work is built to hold up under scrutiny—regulators, lenders, and courts included.

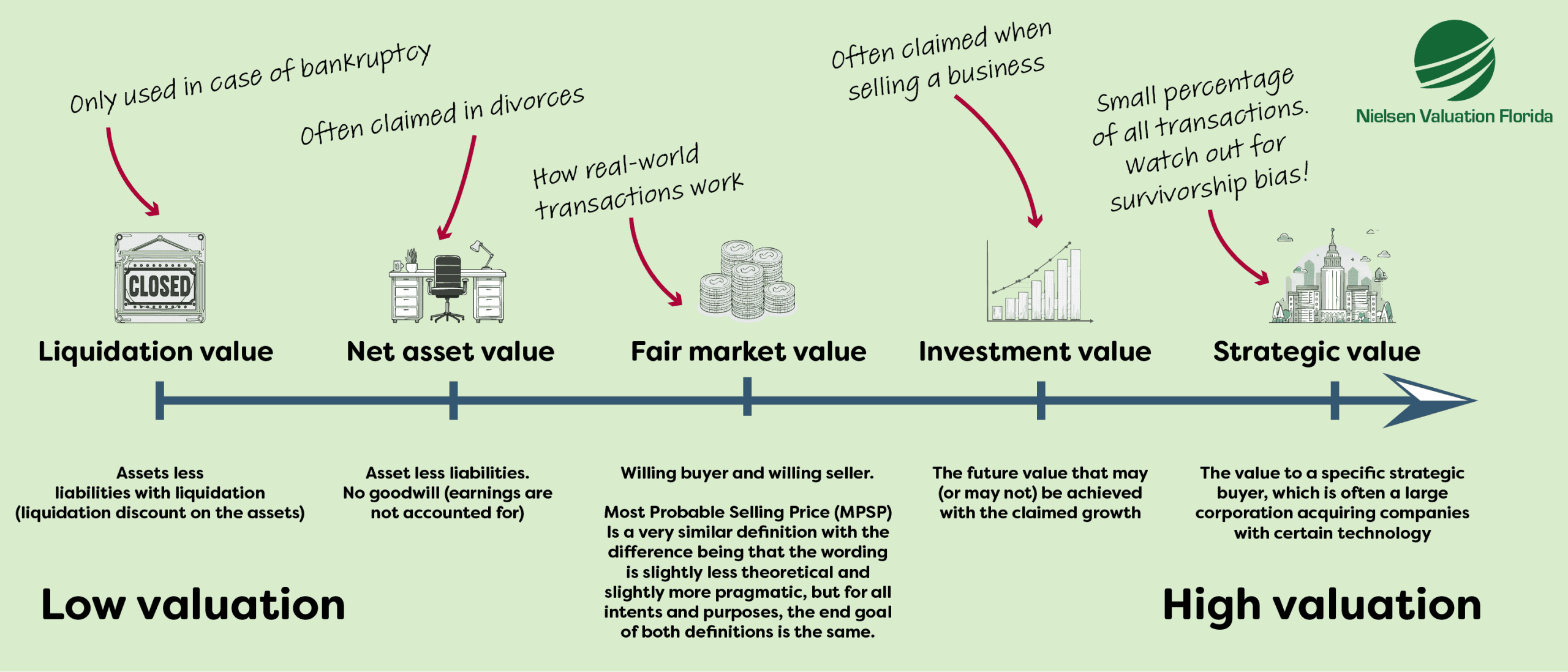

We follow the guidance in Internal Revenue Service (IRS) Revenue Ruling 59-60. That means no preset formulas, no standardized cap-rate tables, and no theoretical marketability discounts detached from reality.

Applied to our Miami assignments, this yields reliable, non-speculative conclusions that reflect what the market would actually pay for a business, information that can be used confidently in negotiations or litigation.

Look Past the Ledger

Taking financial statements at face value is a common error in valuation.

At Nielsen Valuation Florida, we focus on economic reality, not just reported figures.

Why it matters:

- Balance sheets reflect book value, which often diverges from market value.

- Income statements can include one-offs, timing quirks, or owner-specific items.

So we normalize first. Think of a Miami boatyard: most of the time goes into hull prep; the finish coat is the easy part. Valuation is similar: the upfront work drives the quality of the result.

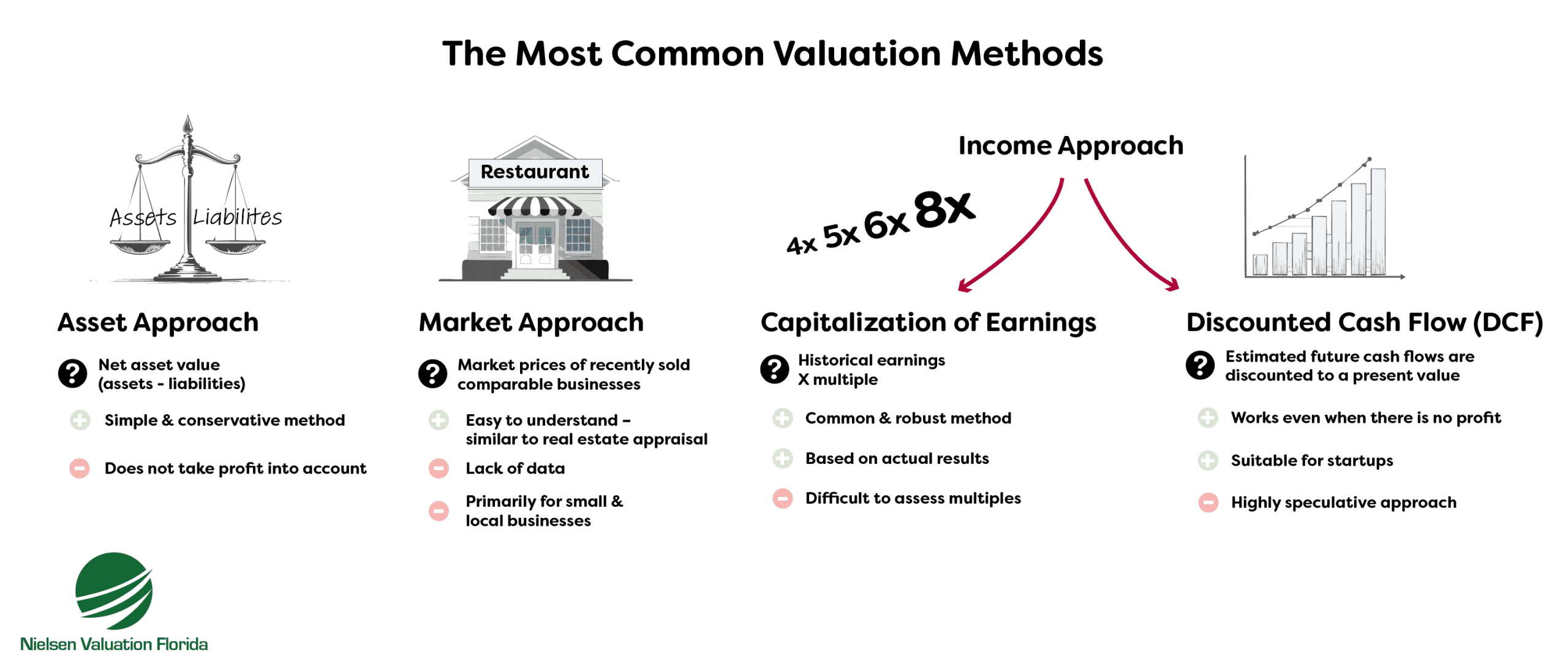

Methods Matched to Your Situation

We use no plug-and-play formulas. We analyze the business and apply the method, or mix of methods, that best fits your situation.

The three primary approaches are used:

- Market approach – informed by what comparable businesses in Miami/South Florida actually sell for

- Asset approach – net market value of assets minus liabilities

- Income approach – value derived from earnings/cash flow and risk

Tailored Business Valuations

No two companies are identical, and neither are our valuations. From the first conversation, we tailor the scope to your goals. Start with a free 30-minute consultation. We’ll outline a right-sized plan and send a customized quote. You’ll pay only for what you truly need, nothing extra.

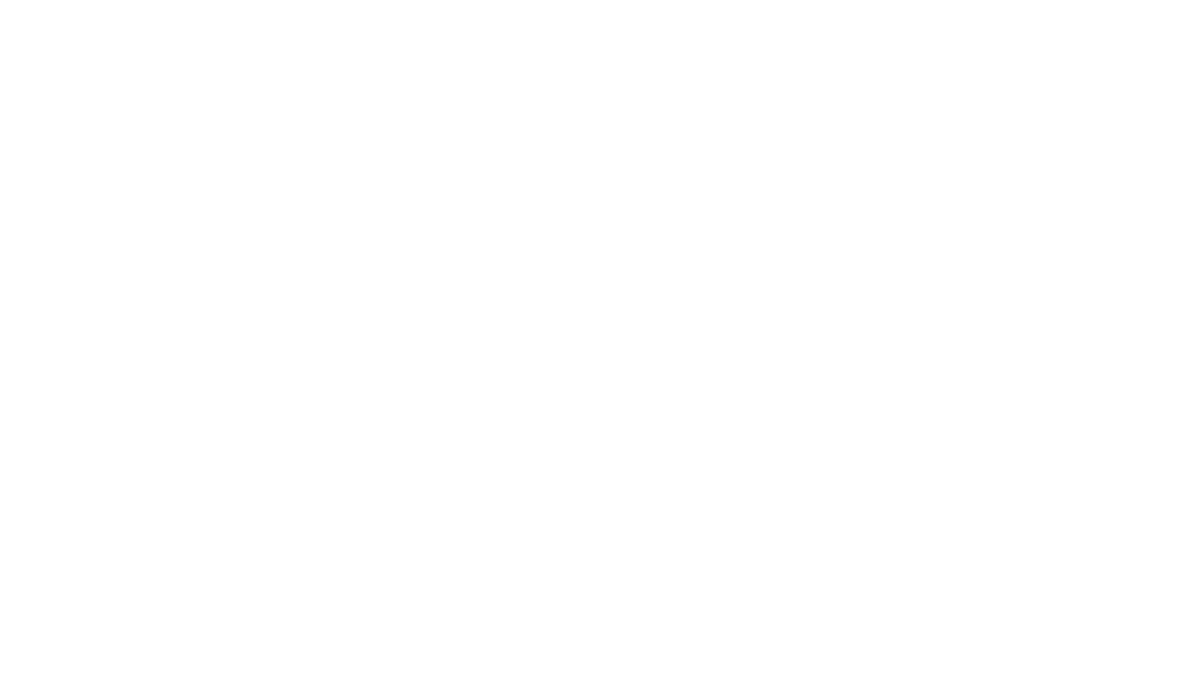

What Is My Miami Business Worth?

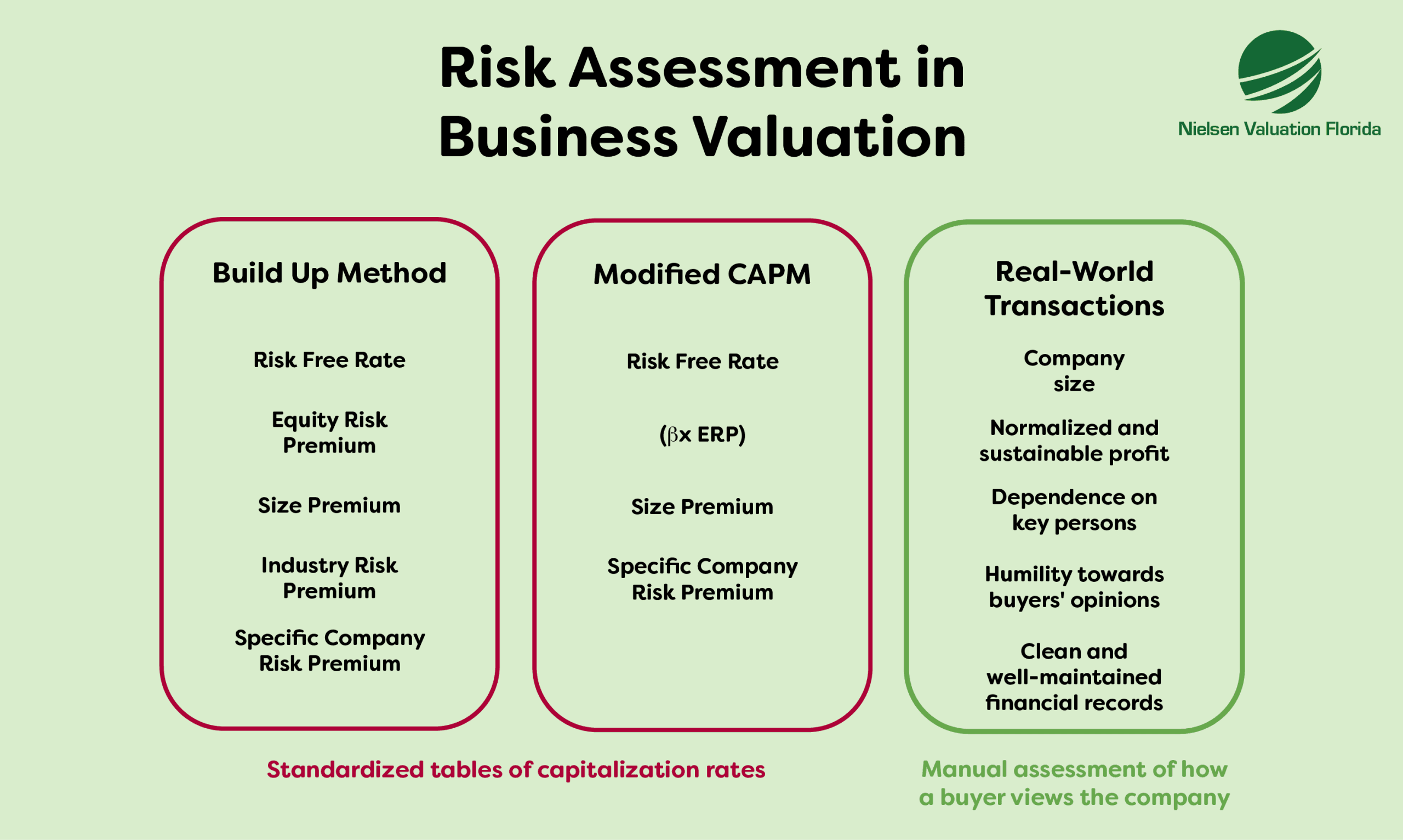

When you plan to sell a business, the number that matters is market value: the price a well-informed buyer would actually pay, not a theoretical figure.

We frequently find two misconceptions among business sellers:

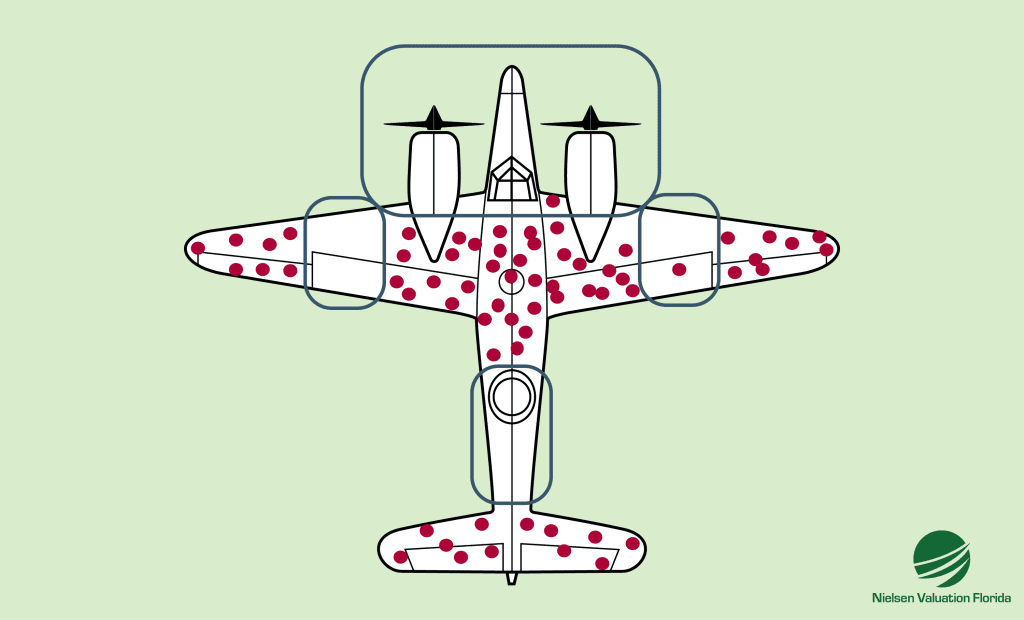

A frequent pitfall is pricing today for tomorrow’s hopes. But buyers expect to earn the upside they create with their capital and effort. An unbiased valuation anchors expectations to what exists now, not what “might” exist in a few years’ time.

Another trap is survivorship bias. Pointing to outlier success stories (e.g., PayPal, Spotify, Alphabet, Meta) overlooks how many ventures actually never get there. Savvy buyers price that risk.

Let’s Value Your Miami Business

Book a free 30-minute consultation. We’ll answer your questions about our Miami valuation services and scope a proposal that fits your needs.