Nielsen Valuation Florida is the go-to partner for rigorous business valuations across the Sunshine State. We deliver objective, IRS-compliant opinions of value, practical, defensible, and free from speculation. Speak with us today about your Florida business appraisal.

Where We Work in Florida

Nielsen Valuation Florida serves clients in these key hubs:

We routinely meet owners on-site across Florida – from Jacksonville and St. Petersburg to West Palm Beach, Naples, Sarasota, Tallahassee, Pensacola, Gainesville, Clearwater, Boca Raton, and Cape Coral.

A Snapshot of Nielsen Valuation Florida

We produce independent, well-supported valuations that reflect how deals actually get done in Florida markets.

Our focus is fair market value based on present facts, not lofty projections, so buyers and sellers can act with confidence.

Every assignment starts with deep financial diligence. We normalize the P&L and balance sheet to remove one-offs, owner items, timing quirks, and non-operating noise before we calculate.

When appropriate, we apply market-observed discounts for lack of marketability instead of relying on theoretical shortcuts.

The result: a credible conclusion of value that stands up in transactions, planning, and disputes.

Business Valuations Aligned with IRS Guidance

Our work adheres to IRS Revenue Ruling 59-60 from start to finish.

In practice, that means we prioritize real-world transactions and evidence alongside established standards.

This approach emphasizes the drivers of actual deal outcomes rather than classroom theory.

Here’s what we deliberately avoid:

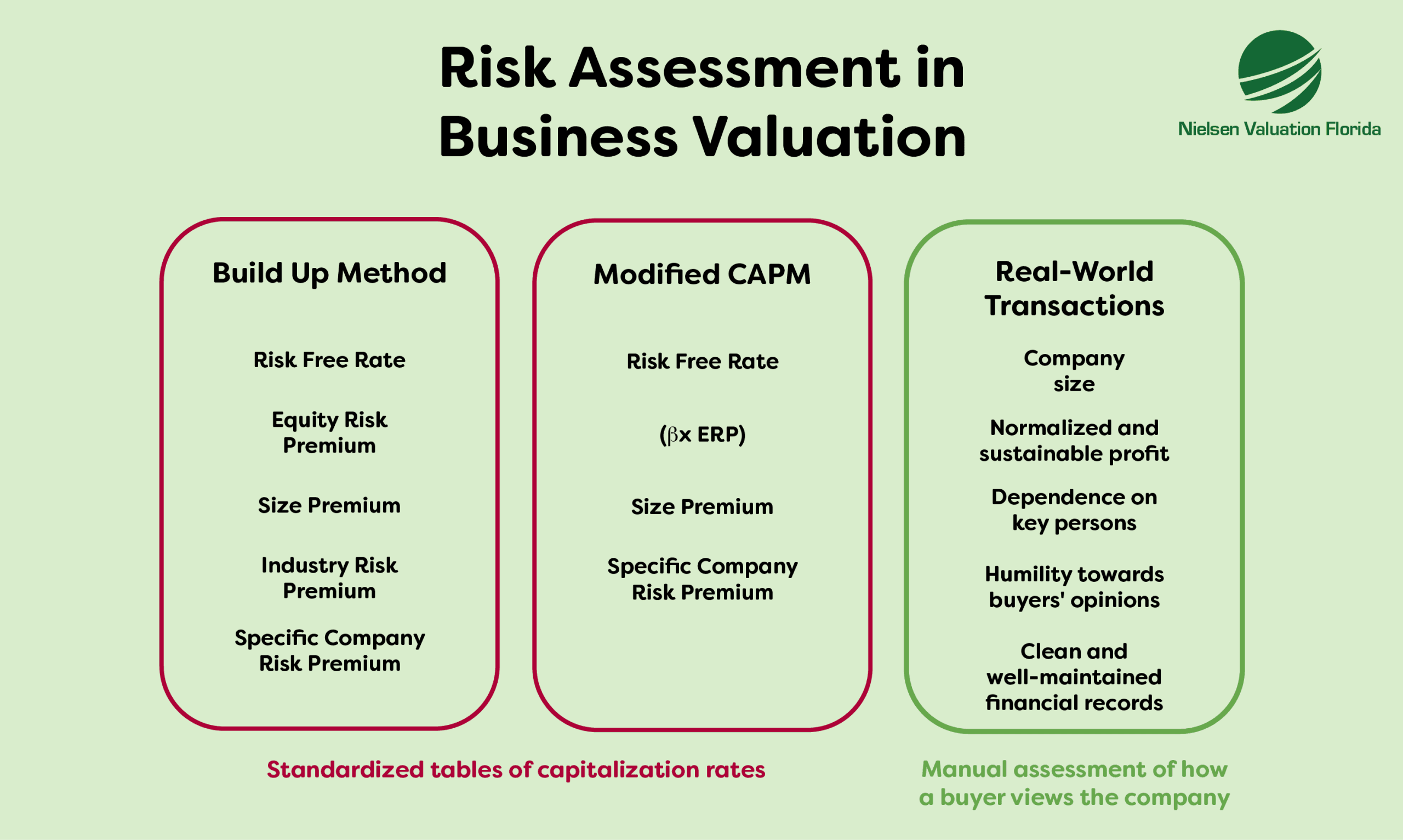

No One-Size-Fits-All Cap Rates

We do not use standardized cap-rate tables in our Florida assignments. They overlook company-specific risk, cyclicality, and operating realities.

Instead, we assess business model, risk profile, growth durability, and earnings stability.

This is consistent with IRS Ruling 59-60, which states:

”No standard tables of capitalization rates applicable to closely held corporations can be formulated.”

We Don’t Do Plug-and-Play Formulas

Spreadsheet outputs without context aren’t valuations. Judgment applied to normalized data is.

Many quick “valuations” skip this. We don’t.

The IRS is clear:

“Valuations cannot be made on the basis of a prescribed formula.”

“No general formula may be given that is applicable to the many different valuation situations arising in the valuation”

“Such a process excludes active consideration of other pertinent factors, and the end result cannot be supported by a realistic application of the significant facts in the case except by mere chance.”

We perform a full review of operations and history, and when useful we interview management and tour the site to inform our conclusions.

Marketability Discounts Based on Real Deals

Some interests don’t trade quickly at fair market value. Where warranted, we apply discounts grounded in observed market behavior, not abstract models.

The contents of RR 59-60 are available in the appendix of this document.

Florida Business Valuation Services

Independent Valuations for Florida Companies

From small professional firms to middle-market enterprises, we provide objective valuations across industries statewide (start-ups excluded).

Preparing to Sell

Selling in Miami, Orlando, Tampa, Fort Lauderdale or elsewhere? A third-party valuation sets a defensible asking price, earns buyer trust, and can reduce time on market.

Planning Your Exit

We benchmark value today, identify drivers, and help you position the company for a smoother transition and stronger proceeds later.

Buying or Investing

Considering a Florida acquisition? We sanity-check pricing, facilitate discussions as an independent voice, and confirm whether the deal pencils out.

M&A Support

Walk into negotiations with a valuation that commands respect. Our independent work helps align expectations and build trust on all sides.

Valuing Owner-Operated & SMB Firms

We regularly value closely held Florida businesses. Professional services, construction, marine, healthcare, hospitality, logistics, and more (early-stage start-ups excluded).

Valuation for Planning & Strategy

A balanced, independent valuation clarifies long-term choices: capital allocation, succession, financing, and wealth planning.

ESOP Share Pricing

We determine fair share values for ESOPs and related equity events so plans meet regulatory and fiduciary expectations.

Partner Buyouts & Redemptions

We establish a fair price for ownership transfers and can assist with the share transfer documentation.

Shareholder Matters

Prevent or resolve disputes with a defensible valuation before agreements are drafted, or to support ongoing conflicts. We can assist with the paperwork as well.

Divorce & Marital Dissolution Valuations

When ownership interests are part of a divorce, our objective valuation provides a reliable basis for negotiation and settlement.

Expert Valuation for Litigation

We bring substantial litigation experience. Our reports follow IRS guidance and are crafted to withstand scrutiny in court.

Gifts, Estates & Trusts

We determine fair values for estate planning and gifting so your allocations are clear and well-documented.

Tax-Related Valuations

We help you document value properly for transactions and filings, reducing risk and avoiding surprises at tax time.

Business Valuation Methods: How We Determine Value

Picking the right method—and applying it correctly—is essential to a reliable fair market value.

We select and execute the approach, or blend of approaches, best suited to your company and your use case.

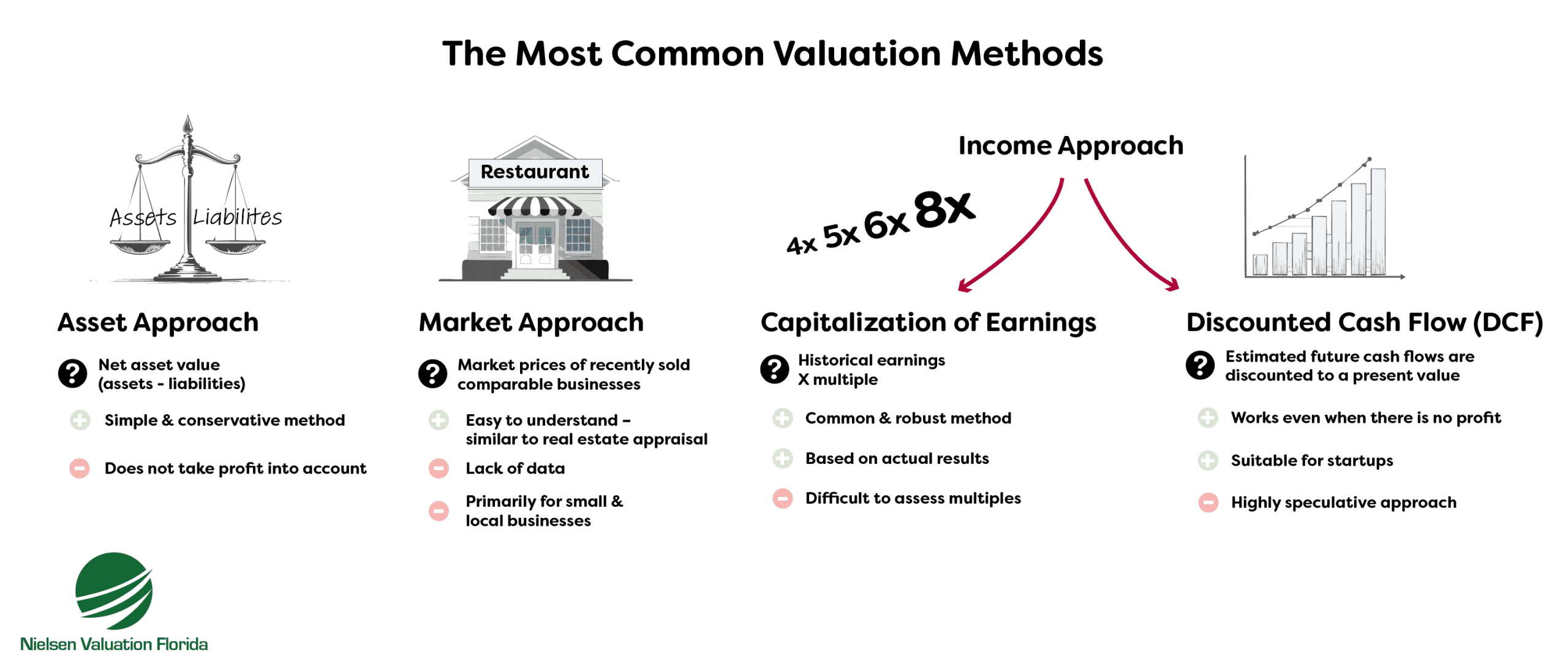

Most methods fall into three families:

- Asset Approach

- Income Approach

- Market Approach

A quick tour:

Asset-Based Approach

The asset approach starts with net asset value: market-value assets minus liabilities. We adjust from book to market so the result reflects fair value.

Great for asset-intensive companies, but because it ignores earnings, we often pair it with the income approach.

Read more about the asset approach

Market (Comparables) Approach

The market approach estimates value from what comparable businesses sell for.

Persuasive when the data is clean and timely. We remove outliers and scrutinize sources before using them.

Often combined with the income approach for a tighter triangulation.

Read more about the market approach

Income Approach (Earnings-Based)

The income approach values a company on risk-adjusted future earnings.

We typically use capitalization of earnings for stable cash flows and DCF when warranted by the facts (with clear disclosure of assumptions).

Read more about the income approach

Blending Methods: Combining vs. Weighting

It’s common to combine or weight approaches.

Key distinction:

- Weighting assigns percentages to different approaches (e.g., 30% asset / 70% income).

- Combining often layers net asset value onto an income result.

Illustration of weighting:

- Assets $1,000,000; liabilities $500,000 → net asset value $500,000.

- Earnings $3,000,000; multiple 3× → $9,000,000 (income approach).

- 50/50 weight → $250,000 + $4,500,000 = $4,750,000.

As you can see there is a problem with this approach. Rigid weighting without judgment can mislead. And as the IRS notes:

“Because valuations cannot be made on the basis of a prescribed formula, there is no means whereby the various applicable factors in a particular case can be assigned mathematical weights in deriving the fair market value. For this reason, no useful purpose is served by taking an average of several factors.“

Why Normalization Comes First

Before any math, normalize financials. The formula is easy; getting inputs right is the work.

We adjust for inflated or depressed items on both the P&L and balance sheet to reflect economic reality.

Typical overstatements:

- Intragroup receivables with weak collectability

- Internally created intangibles booked aggressively

- Under-market owner pay inflating profit

Typical understatements:

- Real estate at historical cost vs. current value

- Non-operating expenses pulling earnings down

- Fully depreciated equipment that still has value

Income approaches require a normalized P&L; asset approaches require market-value balance sheets.

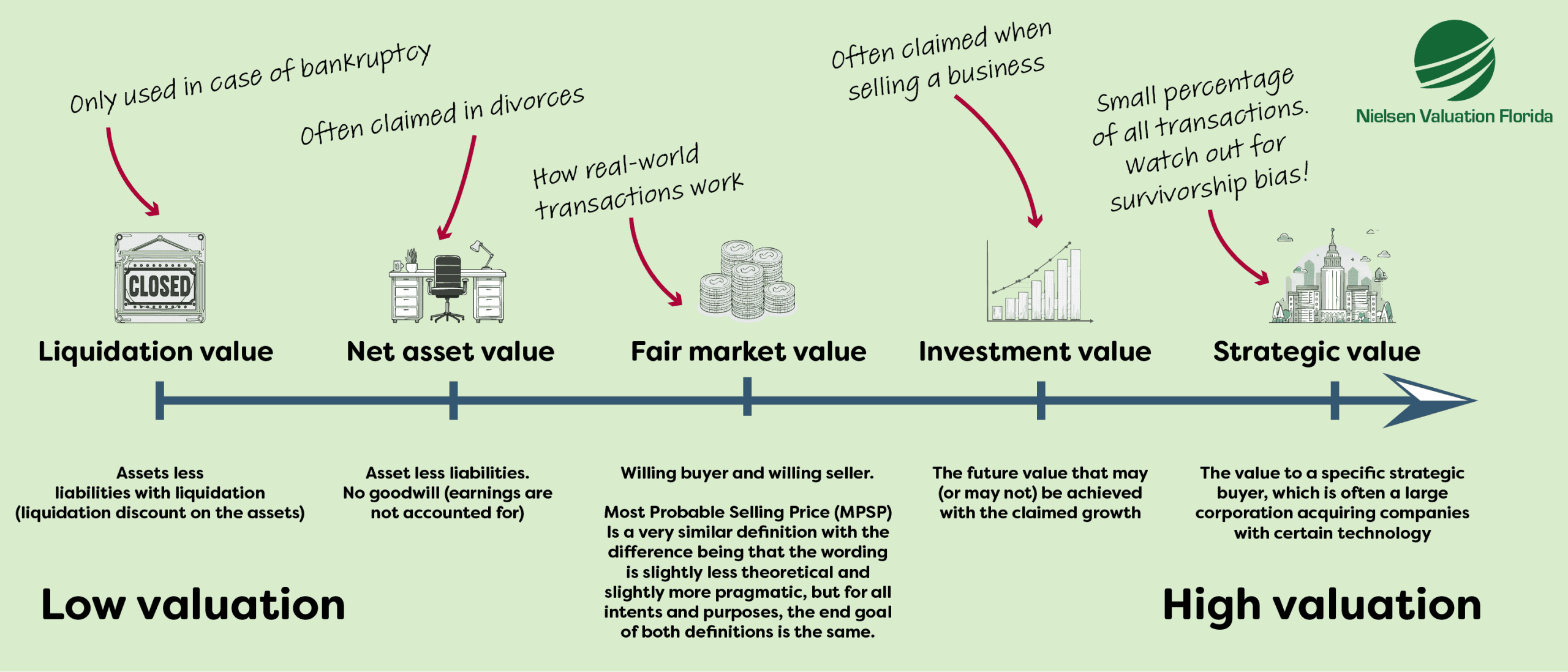

What Could Your Business Sell For?

To price a business for sale, aim for fair market value: the amount a well-informed, unpressured buyer would pay a similarly unpressured seller. The IRS puts it this way:

“Define fair market value, in effect, as the price at which the property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts. Court decisions frequently state in addition that the hypothetical buyer and seller are assumed to be able, as well as willing, to trade and to be well informed”

Blindly averaging past results won’t do. Historical performance must be interpreted against current trends and prospects. As the IRS notes:

“Prior earnings records usually are the most reliable guide as to the future expectancy, but resort to arbitrary five-or-ten-year averages without regard to current trends or future prospects will not produce a realistic valuation.”

Two expectation traps we see often:

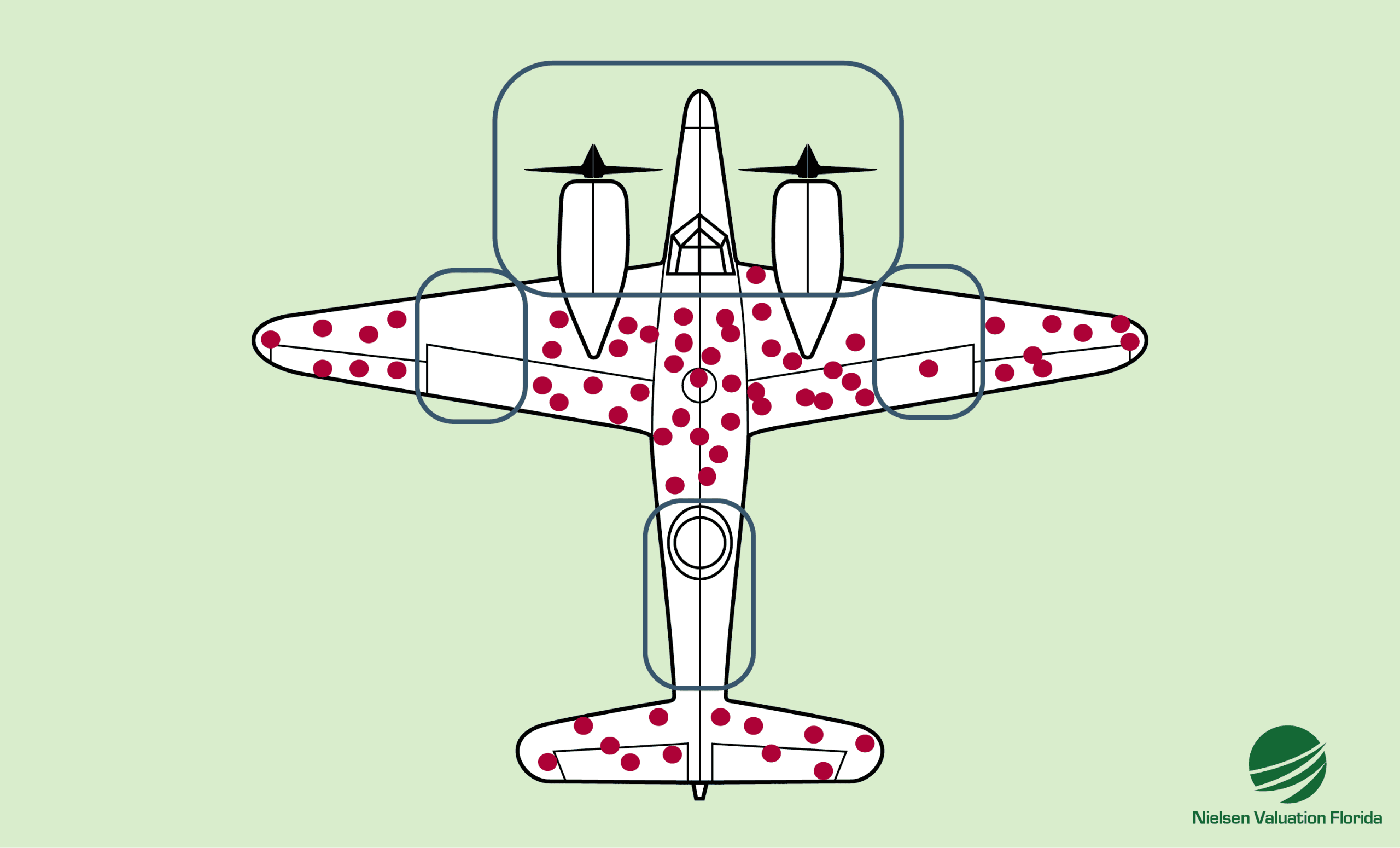

Mistake #1: Survivorship Bias

Studying only the winners skews expectations. Pointing to giants like Spotify or Microsoft ignores the many companies that didn’t make it.

Roughly one in ten startups survives long-term; most do not. Prices grounded in the exceptions rarely clear.

Just looking at the survivors means there is a survivorship bias. The term was coined during WWII, when analysts mapped bullet holes on returning aircraft to decide where to add armor. Seeing few hits on cockpits, engines, and inner wings, they wrongly assumed those areas were safe. The planes hit there never came back. The insight gave rise to the expression “survivorship bias,” a mistake that’s common in business.

Bottom line: buyers pay for evidence, not optimism.

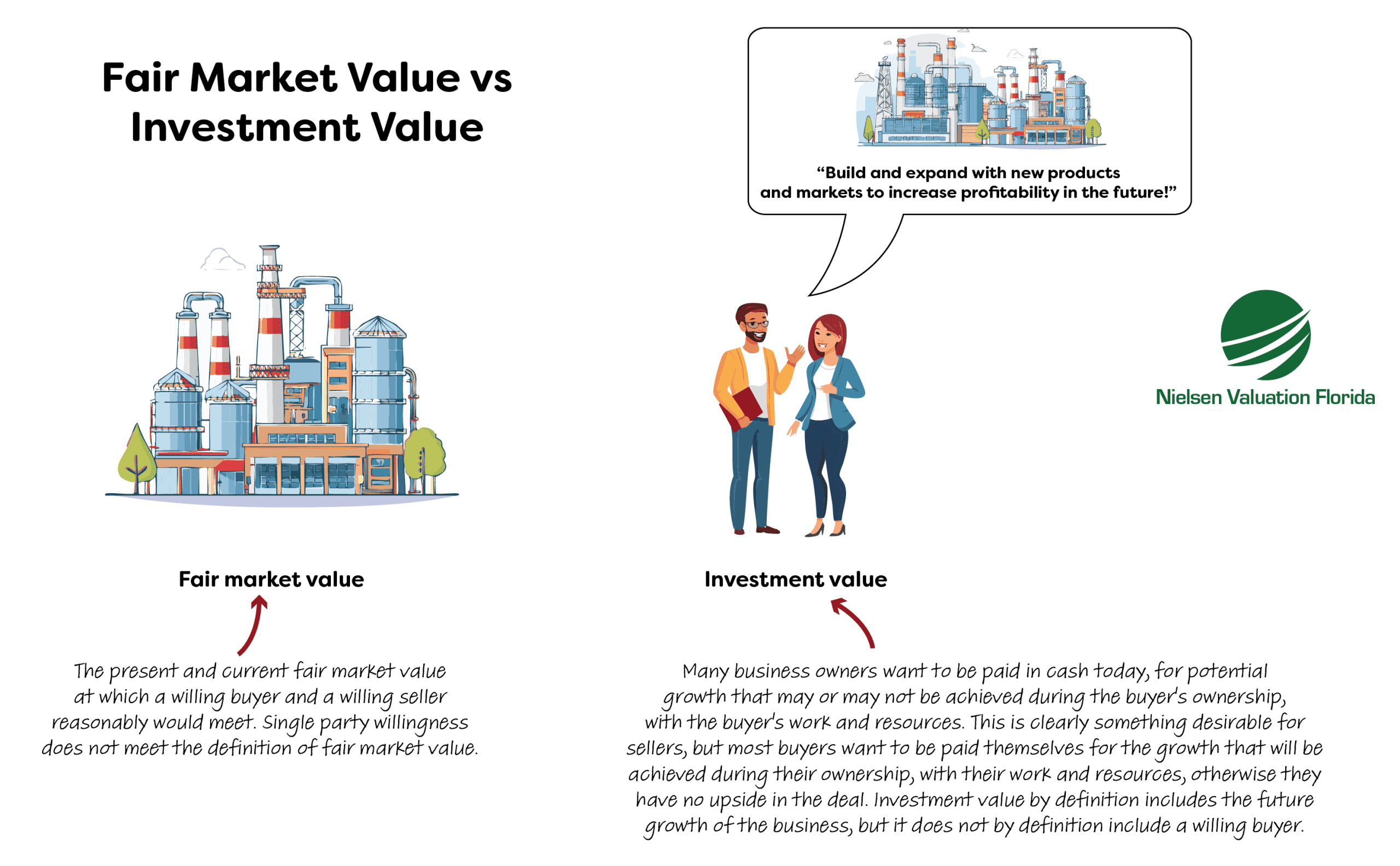

Mistake #2: Mixing Up Fair Market Value and Investment Value

Sellers often try to cash out today for tomorrow’s possibilities, growth that would come from the buyer’s money, effort, and execution. Attractive for the seller, sure, but buyers expect to keep that upside for themselves; otherwise the risk-reward doesn’t pencil out.

That’s the crux: investment value bakes in future gains unique to a specific investor, but it doesn’t guarantee a ready, willing buyer at that price. Buyers typically anchor on fair market value: what an informed party would actually pay today.

Potential Isn’t Price

Some argue buyers should pay premiums for projected growth. Those claims describe possibilities, not the asset being transferred today.

That conflicts with Revenue Ruling 59-60, which requires facts known or knowable on the valuation date.

Analogy: you can’t price a small inflatable raft like a luxury yacht simply because someone could upgrade it later. Price what exists now.

Likewise, buyers shouldn’t prepay for hoped-for improvements. Valuation rests on what’s proven.

Conclusions Tied to the Valuation Date

Revenue Ruling 59-60 requires conclusions be based on facts as they exist at the time of appraisal.

Markets behave the same way: a seaworthy, well-kept yacht commands different pricing than one in disrepair. We value the business that exists today, not a hypothetical future version.

Our analyses respect the letter and spirit of the ruling by focusing on what’s known and measurable, not speculation.

Seven Valuation Pitfalls to Avoid

- Picking the wrong valuation approach: Asset-only for a services firm or income-only for an asset-heavy business both miss the mark.

- Skipping normalization: Book ≠ market; reported profit ≠ economic earnings.

- Ignoring volatility: Small-business earnings swing. Weight periods by representativeness, not habit.

- Not learning the business: Customers, contracts, processes, and people explain the numbers.

- Calculator thinking: Formulas without groundwork mislead.

- Treating value as absolute: Two qualified appraisers can differ; markets decide.

- Letting commissions drive price: Independent valuations help listings attract real buyers at realistic levels.

Why Florida Companies Choose Nielsen Valuation

We’re an independent valuation firm serving companies across Florida. We don’t take commissions or carry hidden agendas. Our sole focus is a defensible, evidence-based opinion of value.

Our work follows IRS guidance and prioritizes market reality over guesswork, with financials normalized to reflect true economics. When appropriate, we apply marketability discounts grounded in real transaction behavior.

Every engagement is tailored to your business and purpose, and we can tour facilities and interview stakeholders to deepen the analysis. Reports are clear and concise, and they stand up in Florida courts and negotiations.

For deals, planning, taxes, or disputes, Florida businesses rely on us.

Start Your Florida Valuation Today

Ready for a clear, unbiased assessment? Contact us for a free consultation and quote.